About

The Real Estate Fund

About

The Real Estate Fund

The Real Estate Fund

Real Estate Investments focusing on

Cash Flow and Capital Growth

Cash Flow and Capital Growth

The Real Estate Fund is a Low Leverage Private Equity Fund

The Real Estate Fund is a Low Leverage Private Equity Fund

created to facilitate the acquisition of investment real estate with a particular emphasis on purchasing value-added multi-family properties. Founded by Randolph De Lano, who has a long history of ensuring consistently high standards and excellent results for his investors, The Real Estate Fund marks his 4th Private Equity Fund.

The Real Estate Fund Team

The Real Estate Fund Team

Decades of Real Estate Investment Experience

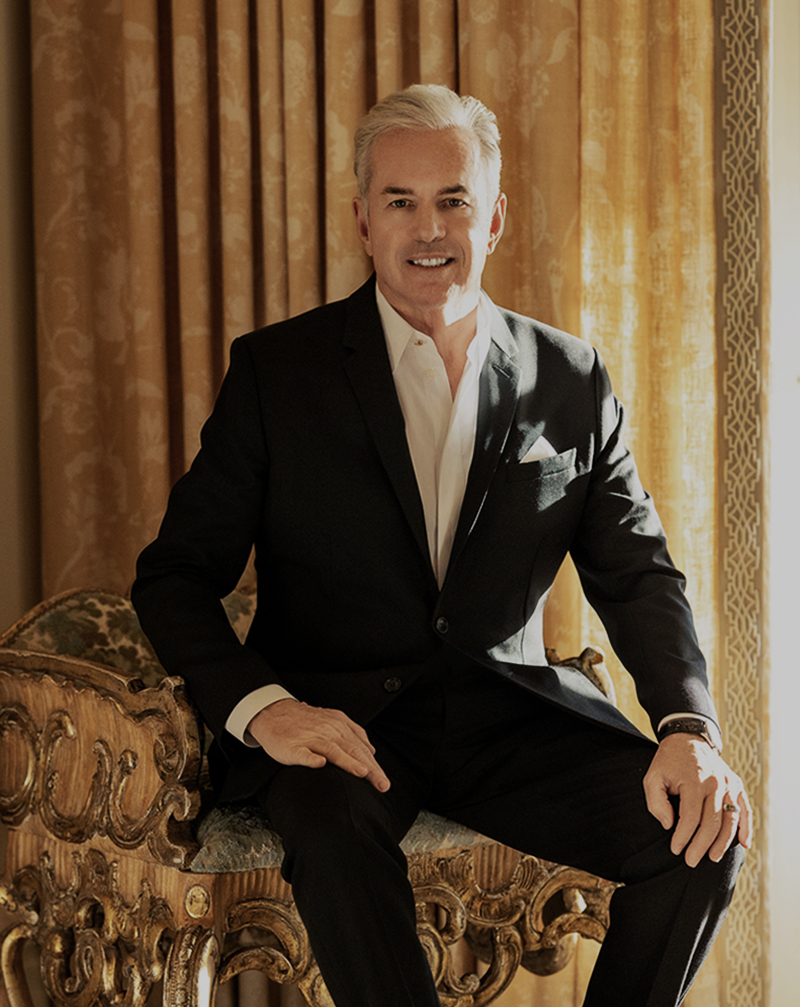

Randolph De Lano, the Founder of The Real Estate Fund, has a long history of ensuring consistently high standards and excellent results for his investors. That service will continue to be applied to the properties this new Fund acquires and manages.

Randolph De Lano, the Founder of The Real Estate Fund, has a long history of ensuring consistently high standards and excellent results for his investors. That service will continue to be applied to the properties this new Fund acquires and manages.

The Real Estate Fund will put its investors first with the goal of creating consistent per- property Monthly Cash Flow and Capital Growth for their property investments. The Real Estate Fund Founder or affiliates will invest directly in every property acquisition, so investors can be assured that there is commonality of interest in the goals of The Real Estate Fund’s property investments and management.

The Real Estate Fund Team

The Founder’s Past Performance

Multi-Family Real Estate Investments with Proven Returns

1995-2005

During the period of 1995–2005, De Lano and his then-partner acquired numerous multi-family properties. They renovated, managed, and sold each property. All of the properties produced monthly cash flow and eventually a profit on sale with an Annualized Return on Investment for their investors of over 25%.

2003-2016

During the period of 2003–2016, De Lano financed several start-up restaurant concepts. De Lano’s investors realized Annualized returns of 20% to 168% on these ventures.

2010-2019

Finally, from 2010 to 2019, De Lano acquired a variety of real estate properties that included multi-family, commercial, industrial, retail, and single-family. All properties required some type of renovation and hands-on management. These investments created an Annualized Return on Investment of just under 24%.